From the economist’s perspective market failures basically arise when – From the economist’s perspective, market failures basically arise when the free market fails to allocate resources efficiently, leading to suboptimal outcomes and economic inefficiencies.

Market failures occur when the market mechanism fails to achieve an equilibrium that maximizes social welfare, resulting in various negative consequences for society.

Market Failures from an Economist’s Perspective: From The Economist’s Perspective Market Failures Basically Arise When

Market failures arise when the free market mechanism fails to allocate resources efficiently, resulting in a deviation from the optimal outcome. These failures can occur due to various factors, including externalities, public goods, and monopolies, and can have significant consequences for economic welfare.

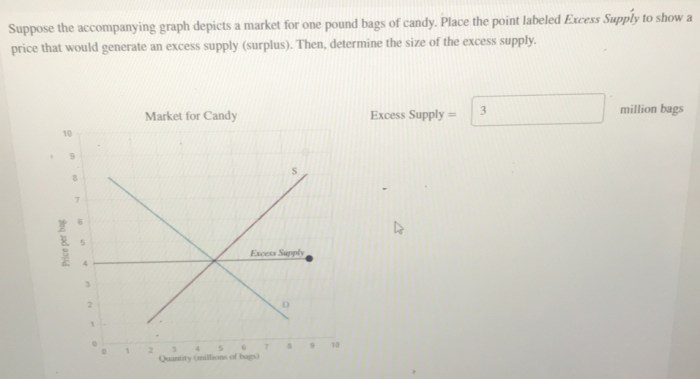

Examples of market failures include pollution, which is an externality that imposes costs on society beyond the producer and consumer; public goods, such as national defense, which are non-excludable and non-rivalrous, leading to underprovision; and monopolies, which can lead to higher prices and reduced consumer choice.

Types of Market Failures

Market failures can be categorized into different types, each with its own unique characteristics and consequences.

- Externalitiesoccur when the actions of one party impose costs or benefits on others who are not directly involved in the transaction.

- Public goodsare non-excludable and non-rivalrous, meaning that they cannot be easily provided by the private sector and often require government intervention.

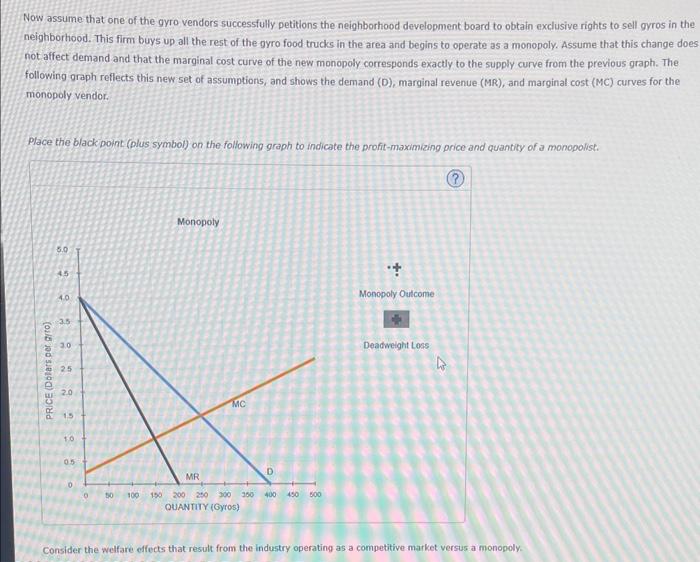

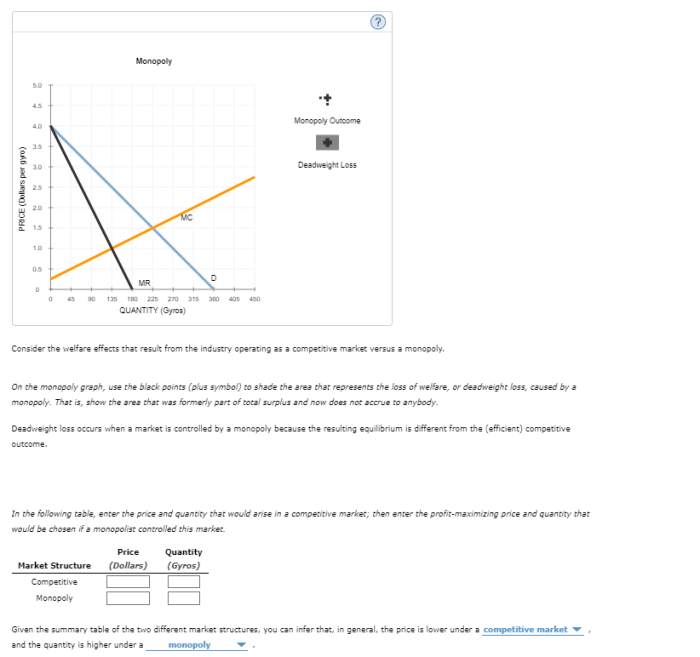

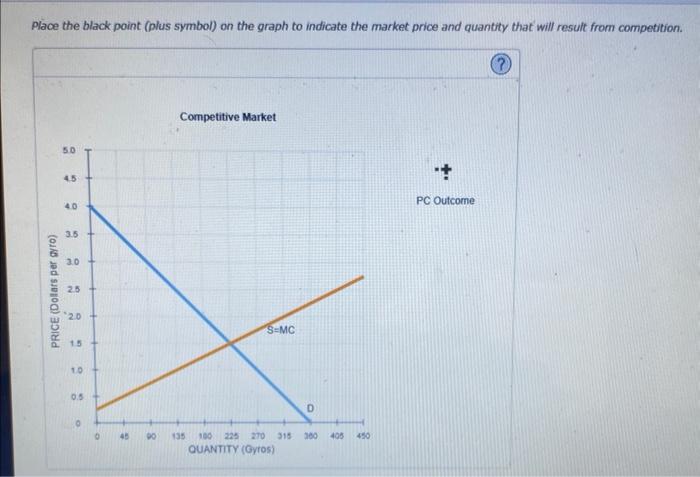

- Monopoliesarise when a single firm has significant control over the supply of a good or service, leading to higher prices and reduced consumer choice.

Causes of Market Failures

Market failures can be caused by a variety of factors, including:

- Externalities: These occur when the actions of one party affect the well-being of others without compensation or penalty.

- Public goods: These are goods or services that are non-excludable and non-rivalrous, meaning that they cannot be easily provided by the private sector.

- Monopolies: These arise when a single firm has significant control over the supply of a good or service, leading to higher prices and reduced consumer choice.

Consequences of Market Failures

Market failures can have significant negative consequences for economic welfare, including:

- Inefficient resource allocation: Market failures can lead to resources being allocated inefficiently, resulting in a loss of potential economic output.

- Reduced economic welfare: Market failures can reduce economic welfare by lowering consumer surplus, producer surplus, or both.

- Social injustice: Market failures can lead to social injustice by disproportionately affecting certain groups in society, such as the poor or the elderly.

Government Intervention in Market Failures

Governments can intervene in markets to address market failures and improve economic welfare. Some common types of government interventions include:

- Taxes and subsidies: Governments can impose taxes on activities that generate negative externalities and provide subsidies for activities that generate positive externalities.

- Regulation: Governments can regulate industries to prevent monopolies from forming or to limit their market power.

- Public provision: Governments can directly provide public goods and services that the private sector is unable or unwilling to provide.

Limitations of Government Intervention

While government intervention can be effective in addressing market failures, it is important to recognize its limitations:

- Government failure: Government intervention can sometimes lead to unintended consequences or create new market failures.

- Rent-seeking: Government intervention can create opportunities for individuals or firms to seek rents or special favors from the government.

- Complexity: Government intervention can be complex and difficult to implement effectively, especially in cases where market failures are complex or involve multiple stakeholders.

Alternative Approaches to Market Failures

In addition to government intervention, there are a number of alternative approaches to addressing market failures, including:

- Private sector initiatives: Private firms can sometimes find innovative ways to address market failures, such as developing new technologies or business models.

- Non-profit organizations: Non-profit organizations can play a role in addressing market failures by providing public goods or services, or by advocating for policy changes.

- International cooperation: International cooperation can be necessary to address market failures that have global implications, such as climate change or financial instability.

FAQ Summary

What are the main causes of market failures?

Market failures can arise due to various factors, including externalities, public goods, monopolies, and information asymmetries.

What are the consequences of market failures?

Market failures can lead to inefficient resource allocation, reduced economic welfare, and negative externalities, such as pollution or congestion.

What role does government intervention play in addressing market failures?

Government intervention can correct market failures through regulations, taxes, subsidies, or the provision of public goods and services.