Accruals are potentially troublesome because they can lead to misstated financial statements, be difficult to estimate, be subject to manipulation, and be used to smooth earnings. This can have serious consequences for investors and other stakeholders.

In this article, we will explore the potential problems with accruals and discuss how to mitigate them.

Accruals Are Potentially Troublesome: Accruals Are Potentially Troublesome Because

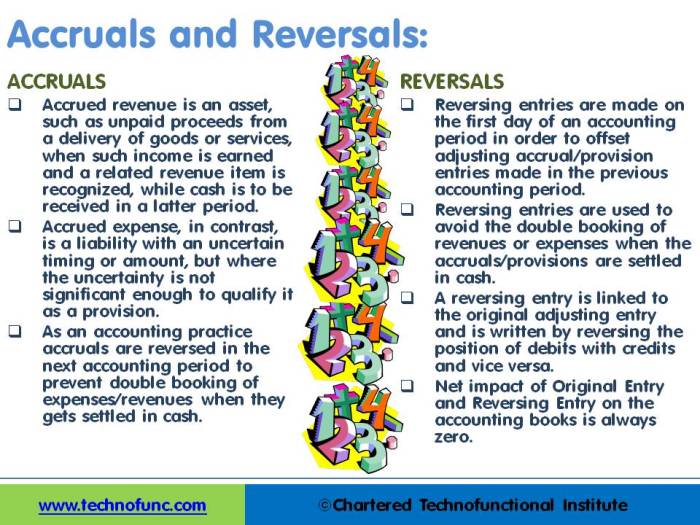

Accruals are accounting entries that recognize revenues or expenses before the related cash has been received or paid. They are used to match revenues and expenses to the periods in which they are earned or incurred, regardless of when the cash is actually received or paid.

Accruals can be used to improve the accuracy of financial statements, but they can also be misleading if they are not properly estimated or disclosed.

Accruals Can Lead to Misstated Financial Statements, Accruals are potentially troublesome because

Accruals can lead to misstated financial statements if they are not properly estimated or disclosed. For example, a company may overstate its revenues by accruing for sales that have not yet been completed. This can lead to investors overpaying for the company’s stock.

Conversely, a company may understate its expenses by not accruing for known liabilities. This can lead to creditors underestimating the company’s risk of default.

Accruals Can Be Difficult to Estimate

Accruals can be difficult to estimate because they are based on future events. For example, a company may have to estimate the amount of warranty expense that it will incur in the future. This estimate can be difficult to make because it depends on a number of factors, such as the quality of the company’s products and the length of the warranty period.

Accruals Can Be Subject to Manipulation

Accruals can be manipulated to improve financial results. For example, a company may accelerate the recognition of revenue or defer the recognition of expenses. This can make the company’s financial statements look more favorable than they actually are.

Accruals Can Be Used to Smooth Earnings

Accruals can be used to smooth earnings. This means that a company can use accruals to make its earnings more consistent from period to period. This can make the company’s stock more attractive to investors.

FAQ Resource

What are accruals?

Accruals are accounting entries that recognize revenue or expenses that have been earned or incurred but not yet received or paid.

Why are accruals potentially troublesome?

Accruals can be potentially troublesome because they can lead to misstated financial statements, be difficult to estimate, be subject to manipulation, and be used to smooth earnings.

What are the consequences of misstated financial statements?

Misstated financial statements can have serious consequences for investors and other stakeholders. They can lead to incorrect investment decisions, lost confidence in the company, and even legal action.