Welcome to Travel Card 101 Answers Version 3, your ultimate resource for navigating the world of travel cards. This comprehensive guide delves into every aspect of travel cards, empowering you to make informed decisions and maximize your travel experiences.

Whether you’re a seasoned traveler or planning your first adventure, this guide will equip you with the knowledge and insights you need to choose the right travel card, use it effectively, and stay safe while traveling.

1. Understanding Travel Cards

The Basics

Travel cards are specialized payment instruments designed to simplify financial management for travelers. They offer numerous benefits, including:

- Reduced foreign exchange fees

- Increased security compared to cash

- Convenience of carrying multiple currencies on a single card

There are two main types of travel cards:

- Prepaid Travel Cards:Loaded with funds in advance, these cards function like debit cards, but without being linked to a bank account.

- Credit-Based Travel Cards:Function like regular credit cards, allowing users to borrow money and pay it back later. They typically offer rewards and benefits, but may have higher fees.

The choice between prepaid and credit-based travel cards depends on factors such as spending habits, creditworthiness, and preferred features.

2. Choosing the Right Travel Card: Travel Card 101 Answers Version 3

Selecting the optimal travel card requires careful consideration of the following factors:

- Destination:Different countries may have varying acceptance rates for different travel cards.

- Spending Patterns:Estimate your daily expenses to determine the appropriate loading amount for prepaid cards.

- Creditworthiness:For credit-based cards, a good credit score is essential for approval and favorable terms.

- Features and Fees:Compare the features and fees of different cards, including foreign exchange rates, ATM withdrawal fees, and annual fees.

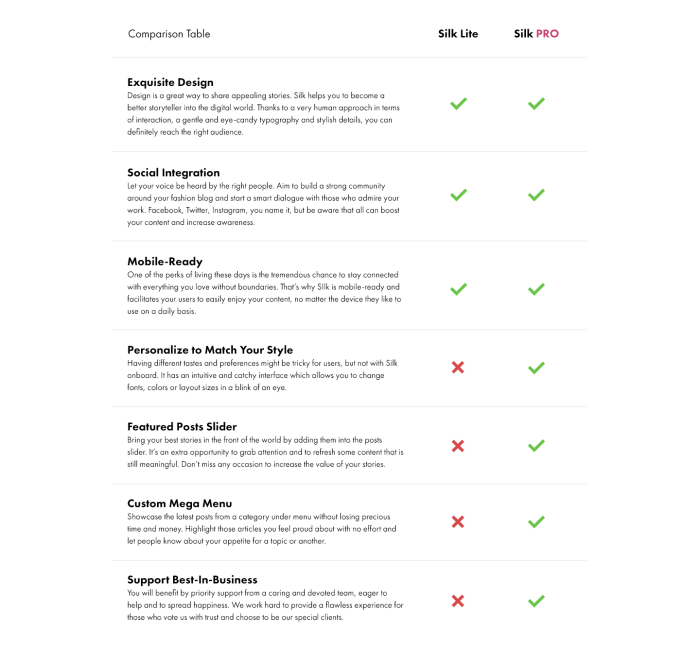

A table comparing the features and fees of popular travel cards can be found below:

| Feature | Card A | Card B | Card C |

|---|---|---|---|

| Foreign Exchange Rate | 1.5% | 2.0% | 1.0% |

| ATM Withdrawal Fee | $5 | $3 | Free |

| Annual Fee | $25 | $50 | $0 |

3. Using Travel Cards Effectively

To load funds onto a prepaid travel card, follow these steps:

- Visit the card issuer’s website or mobile app.

- Enter the card number and amount you wish to load.

- Select a payment method, such as bank transfer or credit card.

- Confirm the transaction.

Travel cards can be used in a variety of ways:

- Point-of-Sale Purchases:Swipe or insert the card at any merchant that accepts the card’s network.

- ATM Withdrawals:Withdraw local currency from ATMs that accept the card’s network.

- Online Transactions:Enter the card details to make purchases or book travel arrangements online.

To manage expenses and avoid fees, consider the following tips:

- Track expenses regularly to avoid overspending.

- Use the card only for essential purchases.

- Be aware of foreign exchange rates and ATM withdrawal fees.

4. Safety and Security Considerations

Travel cards typically offer robust security features, including:

- EMV Chip Technology:Protects against unauthorized card cloning.

- PIN Protection:Requires a personal identification number (PIN) for transactions.

- Fraud Monitoring:Advanced algorithms detect and block suspicious activity.

To protect against fraud and theft, follow these tips:

- Keep the card safe and secure.

- Memorize the PIN and never share it with anyone.

- Report lost or stolen cards immediately.

In case of a lost or stolen card, contact the card issuer immediately to cancel it and request a replacement.

5. Alternative Travel Payment Options

Besides travel cards, other payment options for travelers include:

- Debit Cards:Allow access to funds in a linked bank account, but may incur high foreign exchange fees.

- Credit Cards:Offer convenience and rewards, but can have high interest rates and fees.

- Mobile Wallets:Store digital versions of payment cards and allow contactless payments.

The suitability of each option depends on individual circumstances and preferences.

| Option | Pros | Cons |

|---|---|---|

| Debit Cards | Low fees, direct access to funds | High foreign exchange fees, limited acceptance |

| Credit Cards | Convenience, rewards | High interest rates, annual fees |

| Mobile Wallets | Contactless payments, security | Limited acceptance, reliance on technology |

Frequently Asked Questions

What are the benefits of using a travel card?

Travel cards offer numerous benefits, including competitive exchange rates, reduced transaction fees, added security features, and the convenience of managing expenses in multiple currencies.

How do I choose the right travel card?

Consider factors such as your travel destination, spending habits, currency exchange rates, and fees associated with different cards. Compare features and fees of various cards to select the one that best aligns with your needs.

How do I load funds onto a travel card?

Depending on the card issuer, you can typically load funds via bank transfer, credit card, or cash at designated loading points.

What are the safety features of travel cards?

Travel cards often incorporate security measures such as chip-and-PIN technology, fraud monitoring, and purchase alerts to protect against unauthorized access and fraudulent transactions.

What should I do if my travel card is lost or stolen?

Immediately report the loss or theft to the card issuer and cancel the card. They will assist you in blocking unauthorized transactions and issuing a replacement card.